K. Lloyd Billingsley • Tuesday, September 25, 2018 •

Wait times at the Department of Motor Vehicles are up more than 60 percent, forcing some Californians to stand in line for more than six hours. While Californians wait, the DMV has retained employees who slept on the job for years instead of performing actual work. Complaints prompted politicians to demand an audit, but DMV boss Jean Shiomoto was opposed. Legislators not only backed off the audit, they handed the DMV another $16 million. The problems promptly got worse, with major delays at dozens of offices. As Richard Alcera of Hayward told ABC News, “The earliest appointment I was able to get was in December.”

Last week Governor Jerry Brown announced an audit of the DVM, which Shiomoto duly welcomed. That is no surprise because Brown did not deploy the California State Auditor, an independent agency of great effectiveness. For example, state auditor Elaine Howle’s office uncovered a secret slush fund of $175 million at the University of California, despite efforts by UC president Janet Napolitano to deceive the auditors. For the DMV, Jerry Brown is deploying the state Department of Finance, “the governor’s chief fiscal policy advisor,” previously headed by unqualified incompetents such as Ana Matosantos, with a BA in political science feminist studies. She was the selection of Governor Arnold Schwarzenegger but duly retained by Brown. Current boss Keely Bosler has an advanced degree in economics, but the State Auditor is better suited for the DMV audit.

Under the 2015 “motor voter” law the DMV has been cranking out registered voters who are not, in fact, eligible to vote. By 2016, a full 806,000 ineligibles had been registered, but Secretary of State Alex Padilla won’t reveal how many voted and refuses to cooperate with federal probes of voter fraud, a serious crime. By April 2018, the DMV registered more than one million ineligibles. Brown’s Department of Finance audit won’t yield any information on how many ineligibles manage to vote in November.

The Department of Finance audit won’t even yield a report until March 2019. Californians should not be surprised if few if any reforms are implemented and the DMV, as after recent revelations, gets a hefty budget increase. The DMV did not fire the drone who slept on the job, so a ballpark figure for DMV bosses who will get the axe in Brown’s sham audit is zero. Meanwhile, the DMV is taking appointments for December. Book yours today.

***

K. Lloyd Billingsley is a Policy Fellow at the Independent Institute and a columnist at The Daily Caller.

Craig Eyermann • Tuesday, September 25, 2018 •

On Friday, September 21, 2018, President Trump signed the first of what will be a series of budget bills to fund the U.S. government’s spending in its upcoming 2019 fiscal year, which will begin on October 1, 2018.

The first bill funds the Department of Veterans Affairs, as well as a number of military, energy, and water infrastructure projects, and also the U.S. Congress through September 30, 2018, which marks the end of the U.S. government’s 2019 fiscal year. At the same time, the measure will avoid the risk of a partial government shutdown until at least December 7, 2018, even in the absence of the passage of other spending bills.

The Washington Post‘s Erica Werner describes some of the more notable line items of what a bipartisan majority of U.S. Congress members chose to prioritize in the newly passed budget bill.

Craig Eyermann • Monday, September 24, 2018 •

The U.S. government’s spending has grown by leaps and bounds over the last five and half decades. Will Geary, aka “TransitMapper”, developed a pretty cool side-by-side visualization of the inflation-adjusted growth of the federal government’s major discretionary and mandatory spending programs, which gives an idea of how much the magnitude and share of that spending has grown from 1962 through the present year, as well as how much they are projected to grow through 2023.

Discretionary spending represents expenditures that the U.S. Congress votes upon every year, such as funding for the U.S. military, government agencies, et cetera. Mandatory spending covers programs that the U.S. Congress has set up to be automatically funded, such as Social Security, Medicare, Medicaid, and Affordable Care Act subsidies, and also net interest payments to the people and entities who have loaned money to the U.S. government.

***

Craig Eyermann is a Research Fellow at the Independent Institute and the creator of the Government Cost Calculator at MyGovCost.org.

Robert Murphy • Friday, September 21, 2018 •

On a recent segment of his popular Fox News program, conservative pundit Tucker Carlson took aim at the elite billionaires Jeff Bezos, the Walton family, and Travis Kalanick, arguing that their giant corporations rip off the taxpayers. Carlson claimed that Amazon, Walmart, and Uber underpay their workers—who must turn to government programs just to survive—and use regulations to stifle their competitors.

Although I agree that some corporations (such as Amazon) benefit from cozying up to the government, the basic economic logic in this popular critique is backwards: the food-stamp program tends to raise wage rates by giving workers more bargaining power. Worse, Bernie Sanders’s proposal to impose a 100 percent tax on large employers for every dollar their employees receive in government assistance would directly hurt these very same workers by punishing the companies that hire them.

Alvaro Vargas Llosa • Thursday, September 20, 2018 •

Robert Murphy has reminded us, ten years after the collapse of Lehman Brothers, what the real lessons of the financial crisis were. It now looks as if, having learned the wrong lessons, we might be headed for something nasty once again.

The original sin was the manipulation of money in the form of artificially low-interest rates following the bursting of the dotcom bubble. In the context of a fractional reserve banking system and of a world accustomed to easy money since the beginning of the 1980s, the incentives for too much leverage were irresistible. Artificially low-interest rates had another perverse effect—asset-price inflation. The credit binge and the asset inflation related to mortgages and real estate in particular because, due to political incentives for the lowering of lending standards, a large part of the action was concentrated in that sector.

Everything else people usually associate with the financial crisis of 2008, such as the explosion of securitization or the failure of regulation, was a symptom, not a cause. Given the prevailing system, the incentives were for bankers (both commercial banks and “shadow banking” institutions) to issue short-term debt and invest in long-term securities. Since assets were constantly rising in value, it was assumed refinancing short-term debt against all that collateral would never be an issue. Moreover, the excessive investment in long-term debt also had the effect of lowering long-term rates, creating in turn incentives for malinvestments that would eventually play a key part in the Great Recession.

Mary Theroux • Wednesday, September 19, 2018 •

Women, as well as all shareholders and debt-holders of California firms, should be flooding California’s Governor Jerry Brown’s InBox and Voicemail with calls to veto the recently-passed Senate Bill 826, mandating quotas for women on corporate boards.

Specifically, SB 826 would:

1) Provide for gender diverse representation on corporate boards by requiring each publicly-held corporation headquartered in California to have at least one woman on its board of directors by the end of 2019.

2) Beginning July 2021, the bill requires a minimum of 2 women directors on boards with 5 directors and at least 3 women on boards with 6 or more directors.

Women should be rightly against it because the sole effect will be for existing board members to assume new women board members are only there as quota-fillers who are by definition less qualified than they. I can’t imagine a woman of substance wanting a board seat under such circumstances.

K. Lloyd Billingsley • Tuesday, September 18, 2018 •

Football season is in full swing, and on Saturdays college teams rule the television sports channels. The television deals rake in big money for the National Collegiate Athletic Association (NCAA), which in 2018 will generate $857 million from CBS and Turner Broadcasting alone. NCAA boss Mark Emmert bags a salary of $2.4 million, and Alabama football coach Nick Saban rakes in $8.3 million. Everybody makes big money except those the people pay to watch, the players. They are paid nothing and even barred from endorsement deals. Apologists of the system claim this policy preserves the spirit of amateurism, and that the various colleges pay the players’ tuition. Examples of payment in kind are rare, but here is an illustration.

Robert Higgs • Tuesday, September 18, 2018 •

Everyone who knows me knows that I loathe government as it now exists everywhere. For fifty years, my professional activity has pertained in large part to awful actions that governments at every level have taken. Because governments have been such a pervasive part of social and economic life in the past century or more, bringing into being the welfare/warfare/surveillance/therapeutic/police state under which most people in the world now live, specializing as I have is bound to leave one with a jaundiced view not only of the state but of much of society as well. And such an outlook does not make for personal happiness.

But yesterday, as I set out to walk Fly Boy down the road through the jungle as usual, I was struck by what a beautiful day it was, and I determined to count my blessings. They are too many to enumerate here, but let me simply mention some of the greatest.

William Watkins • Monday, September 17, 2018 •

Today, by statutory law, is Constitution Day. It is more a wake for the dead than a celebration for one that is living. Actually, the Constitution is dead because so many have insisted on it being a living and breathing document. A Constitution should be a lighthouse, a beacon for the people to gaze upon to ensure their liberties are not wrecked upon the rocks by reckless government officers. To perform such a task it must be firmly fixed. If not, then one can never be sure just where the danger lies.

The demise of our Constitution is evident in the recent confirmation fight with Judge Brett Kavanaugh. The fixed nature of originalism so scares the Left that the nominee must be stopped at all costs. The Left depends on a living Constitution to promote and allow various expansions of national power.

So, on this day let us raise our glasses to the good old written Constitution. It is dead, because the Left made it living.

***

William J. Watkins, Jr. is a Research Fellow at the Independent Institute and author of the book, Crossroads for Liberty: Recovering the Anti-Federalist Values of America’s First Constitution.

Craig Eyermann • Monday, September 17, 2018 •

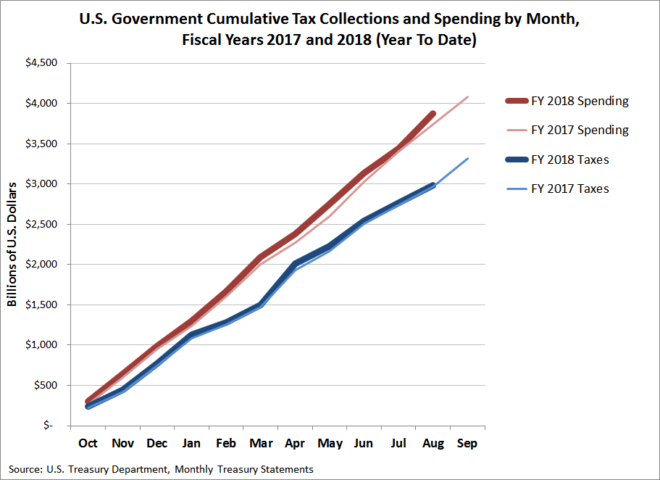

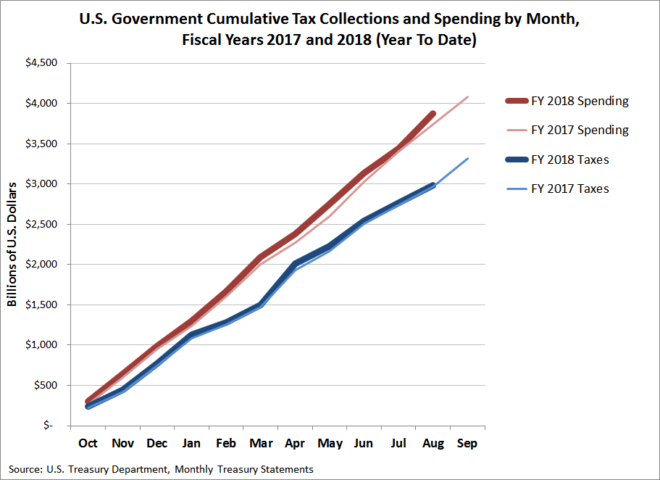

The U.S. government did something in August 2018 that it has never done before. It spent $433 billion in taxpayer and borrowed dollars in a single month!

For the U.S. government’s 2018 fiscal year to date, which will end on September 30th, the cumulative amount of spending it has done is well ahead of where it was at this point in 2017, while the amount of money it has collected in taxes is, perhaps surprisingly, slightly ahead of where it was at this time last year.

You might think this dubious fiscal achievement would attract howls of disapproval on Capitol Hill, but you would be wrong. According to reporting by Damian Paletta and Erica Werner of the Washington Post, there is bipartisan approval for spending even more money, with the only disagreements being over what.