The Federal Student Loan Fiasco

In all the annals of really bad decisions made in the pursuit of political benefit, President Obama’s 2010 federal government takeover of the student loan industry from the private sector has to rank among both the worst and the most costly.

How do we know? Here’s how Cory Turner of National Public Radio recently described what has become the modern day role of the U.S. Department of Education:

“Today, the U.S. Department of Education is, essentially, a trillion-dollar bank, serving more than 40 million student borrowers.”

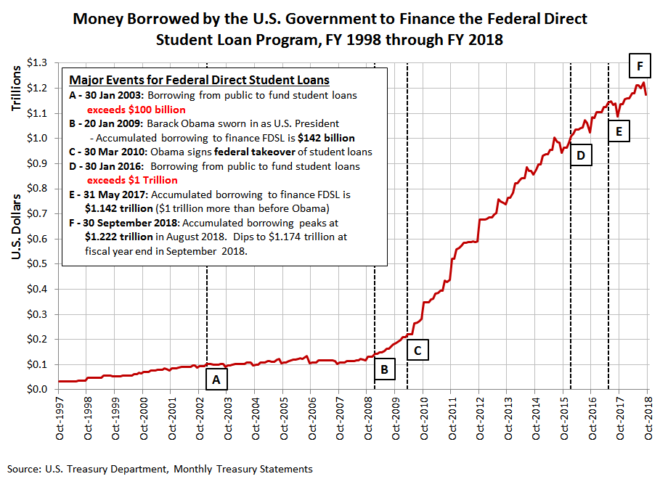

The Federal Reserve puts the numbers at 44.5 million student loan borrowers with a combined student loan debt liability of $1.5 trillion. Meanwhile, the U.S. government has cumulatively borrowed about $1.2 trillion to fund its Federal Direct Student Loan Program, with nearly $1 trillion of that total having been borrowed since President Obama put the U.S. Department of Education into the student loan business in March 2010.

The Education Department’s bureaucracy isn’t doing well in running its student loan business. CNBC reports on the state of defaults and delinquencies that are likely making the program a money loser for U.S. taxpayers instead of the money-maker that President Obama intended.

The Department of Education estimates that just over 10 percent of student loan borrowers are in default, and researchers at the Center for American Progress estimate that as many as 30 percent of student loan borrowers can’t keep up with debt just six years after graduation.

Default and delinquency data like that means that the whole federal takeover of the student loan business from private sector banks has been a costly fiasco and will continue to be for years to come.

***

Craig Eyermann is a Research Fellow at the Independent Institute and the creator of the Government Cost Calculator at MyGovCost.org.