Federal Spending Drives Budget Deficit in 2018

All year long, many Americans have been dreading what the U.S. government’s fiscal state would be at the conclusion of its 2018 fiscal year, which just ended on September 30, 2018. The combination of tax cuts passed into law in December 2017 that slashed corporate income tax rates and a budget deal in February 2018 that boosted federal spending at the same time seemed to be a sure recipe for creating a massive fiscal headache for American taxpayers.

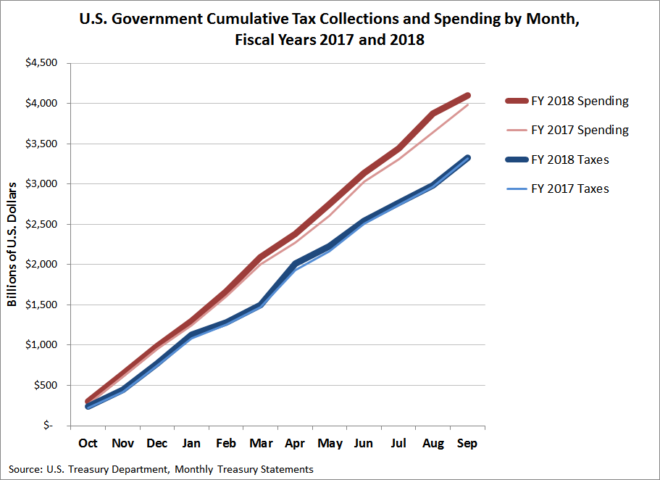

But, only one of these measures appears to have negatively impacted the U.S. government’s fiscal situation since President Trump signed both measures into law. After a four-day delay, the U.S. Treasury Department issued its final monthly treasury statement for the U.S. government’s 2018 fiscal year, where the following chart shows one expected result and one surprising result.

The expected result is what happened with federal spending, which increased from $3.981 trillion in FY 2017 to $4.107 trillion in FY 2018. The unexpected result can be seen in the cumulative total for the U.S. government’s tax collections, which in a year of tax cuts, surprisingly rose from $3.315 trillion to $3.329 trillion. Overall, the U.S. government ran a $779 billion deficit in its 2018 fiscal year, up $113.2 billion from the $665.8 billion deficit in 2017.

According to CNS News, the national debt increased by $1.271 trillion during FY 2018, a $492 billion difference from the $779 billion deficit that the federal government reported for the year.

***

Craig Eyermann is a Research Fellow at the Independent Institute and the creator of the Government Cost Calculator at MyGovCost.org.